Market overviews 2015 — Central and Eastern Europe

At the end of 2014 there were 143 million TV households in Central and Eastern Europe. 69% of TV homes in Central and Eastern Europe received digital TV. 42% of the terrestrial TV platform is still analogue, while two thirds (67%) of the cable TV networks need to be switched to digital.

56% of the TV households subscribe to a pay TV service. The major pay TV platforms in Central and Eastern Europe are cable and satellite, with small number of prominent IPTV operators.

Digitization of cable infrastructure in Central and Eastern Europe is occurring slowly. At end 2014 59.8% of cable homes were served by digital signals. IHS expects that the digitisation of cable in Central and Eastern Europe will not complete before 2020.

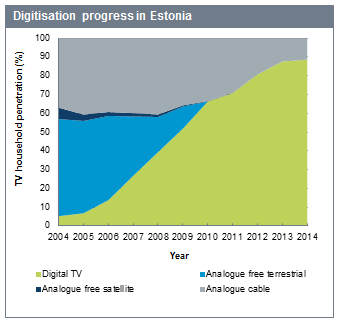

The transition from analogue to digital terrestrial television has started much later in Central and Eastern Europe in comparison with the Western part of the continent. The first DTT transmissions started in Lithuania, Estonia and Slovenia in 2006. Many non-EU countries are set to miss the 2015 deadline for digitizing their terrestrial TV platform.

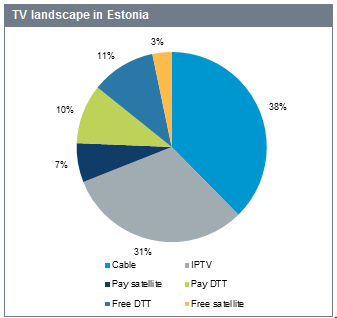

The DTT platform in Central and Easter Europe is predominantly a FTA service, as less than 1 million households had subscribed to a DTT pay service (the Baltic states of Estonia and Latvia had the majority of pay DTT subscribers).

Russia Key facts – 2014

- Population: 139.2 million

- Households: 57.4 million

- TV Households: 54.6 million

- Pay TV Penetration: 66%

- Broadband Penetration: 48%

- Mobile Penetration: 167%

TV Ad Revenue: €3.2 billion

| Russia — platform overview 2014 | |||

| Pay subs (‘000) | Free subs (‘000) | Platform digitization (%) | |

| Terrestrial | 0 | 13,048 | 68 |

| Satellite | 14,313 | 5,600 | 99 |

| Cable | 17,480 | 0 | 20 |

| IPTV | 4,187 | 0 | 100 |

| Total | 35,980 | 18,648 | 66 |

The public broadcaster in Russia is All-Russia State Television and Radio Broadcasting Company (VGTRK), transmitting three free-to-air channels that are available nationwide (Russia 1, Russia 2, Russia 24) and one pay TV channel (Russia K). VGTRK is owned by the federal government which also owns 75% of Channel One (Perviy Kanal) – the most-watched Russian channel. Channel One mainly broadcasts international series and some sports events. Gazprom Media operates two free-to-air channels (NTV and TNT) and a number of pay TV channels (including the NTV Plus channels).

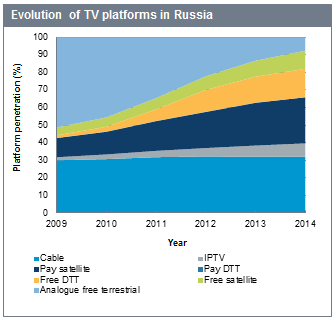

Cable TV and IPTV platforms are prevalent in major cities while the satellite platform is used in the more remote parts of the vast territory of the Russian Federation. Also some DTH operators only operate in a certain region of the country. For example, Vostochny Express only operates in Siberia and the far east of the Russian Federation (using the Express AM5 satellite at orbital slot140°E).

The main three free-to-air channels (First Channel, Rossiya and NTV) are state-owned and reach over 90% of the country’s territory. These are very popular among the Russian viewers: over 70% of the population routinely watches national television channels.

In December 2009 the Government set out a plan to complete the switchover of the analogue terrestrial signal to digital by 2018 following a missed 2015 deadline. At the end of 2014 there were 4.2 million households using only analogue free terrestrial TV, around 0.2 million analogue DTH users and 13.95 million analogue cable TV subscribers.

Currently the first terrestrial multiplex RTRS-1 is available to approximately about 85% of the population and RTRS-2 is available in 74 regions (to over 50% of the population). The Russian Television and Radio Broadcasting Network are also using the Express-AM33 satellite to transmit five national channels to the free-to-air DTH users in remote areas of the country unable to receive DTT.

At the end of 2014 the largest pay TV operators were satellite operator Tricolor, cable operator Rostelecom and multi-platform operator MTS.

Poland Key facts – 2014

- Population: 38.2 million

- Households: 13.9 million

- TV Households: 13.4 million

- Pay TV Penetration: 83%

- Broadband Penetration: 59%

- Mobile Penetration: 145%

TV Ad Revenue: €826 million

| Poland — platform overview 2014 | |||

| Pay subs (‘000) | Free subs (‘000) | Platform digitization (%) | |

| Terrestrial | 135 | 1,858 | 100 |

| Satellite | 6,331 | 386 | 100 |

| Cable | 4,364 | 0 | 55 |

| IPTV | 326 | 0 | 100 |

| Total | 11,156 | 2,244 | 85 |

Poland is one of the largest and most prosperous countries in the Central and Eastern Europe (CEE) region with an advanced pay TV industry and extensive fibre optic infrastructure.

The public broadcaster in Poland is Telewizja Polska (TVP). TVP offers seven free-to-air channels and two pay-TV channels (TVP Seriale and TVP Sport). TVP 1 is the most popular Polish channel which shows local series, documentaries and cooking shows as well as live sporting events. Polish media conglomerate ITI Group provides two free-to-air channels and a number of TVN pay TV channels. Commercial broadcaster Polsat Group operates two free-to-air channels, Polsat, one of the most popular Polish channels, and Polsat Sport News, alongside a number of pay TV channels.

Cable TV is prevalent in large cities. Overall however satellite TV is more popular in Poland, with satellite as a whole accounting for 50% of the TV market in comparison to cable’s 33%.

Poland completed the analogue terrestrial signal switch-off in July 2013.The DTT offer in Poland is very strong: the three out of four multiplexes (free, available to 98.8% of population) contain 23 unique channels and the HD versions of the national broadcaster’s two main channels, TVP1 and TVP2. As a result of the strong offering,1.86 million households have free DTT as the primary source of TV and 0.43 million have free digital DTH. No households receive analogue DTH signal.

Out of Poland’s 13.40 million TV households 11.2 million opted for pay TV over cable, DTT, IP or satellite. This is a result of Poland being one of the most economically developed countries in the region with high demand for premium content. The largest pay TV operators are UPC, Cyfrowy Polsat and nc+.

Estonia Key facts – 2014

- Population: 1.34 million

- Households: 0.6 million

- TV Households: 0.6 million

- Pay TV Penetration: 86%

- Broadband Revenue: 77%

- Mobile Revenue: 158%

TV Ad Revenue: €26 million

| Estonia — platform overview 2014 | |||

| Pay subs (‘000) | Free subs (‘000) | Platform digitization (%) | |

| Terrestrial | 56 | 61 | 100 |

| Satellite | 37 | 18 | 100 |

| Cable | 208 | 0 | 70 |

| IPTV | 174 | 0 | 100 |

| Total | 475 | 79 | 89 |

Eesti Television is the public broadcaster in Estonia, which offers two channels in Estonian–ETV and ETV 2–alongside a Russian language channel, ETV+. Eesti Television’s ETV is the second most popular channel in Estonia, showing series, documentaries and sporting events. The most popular channel however is private television station Kanal 2, which shows a large number of Estonian and international sitcoms. The Modern Times Group, a Swedish media conglomerate, has three FTA channels in Estonia: TV3, TV6 and TV8.

The analogue terrestrial signal switch-off took place in July 2010. There are four multiplexes in Estonia, two of which are free. The free-to-air sector in Estonia is currently decreasing however as pay TV continues to grow. This growth has been particularly led by IPTV, which at the end of 2014 accounted for 31% of TV households. At the end of 2014 the largest pay TV operators were IPTV operator Elion and satellite operator Starman. In general cable TV is prevalent in Estonia, particularly in the cities because of the existing infrastructure. IPTV is popular in parts of the country with high-speed internet connections.

Croatia Key facts – 2014

- Population: 4.4 million

- Households: 1.7 million

- TV Households: 1.65 million

- Pay TV Penetration: 43%

- Broadband Penetration: 57%

- Mobile Penetration: 113%

TV Ad Revenue: €96 million

| Croatia — platform overview 2014 | |||

| Pay subs (‘000) | Free subs (‘000) | Platform digitization (%) | |

| Terrestrial | 48 | 898 | 100 |

| Satellite | 111 | 39 | 100 |

| Cable | 154 | 0 | 69 |

| IPTV | 394 | 0 | 100 |

| Total | 707 | 938 | 97 |

Croatia’s public broadcaster is Hrvatska Radiotelevizija (HRT) which offers four free-to-air channels in Croatian across the country: HRT 1, HRT 2, HRT 3 and HRT 4. HRT also provides an international channel which is aimed at the Croatians living abroad. Commercial broadcaster Central European Media Enterprises (CME) provides two free channels (Nova TV and Doma TV) and RTL Televizja, a commercial broadcaster owned by RTL Group, offers three channels (RTL, RTL 2 and RTL Kockica). Privately owned HOO TV broadcasts SPTV, a free-to-air sports channel.

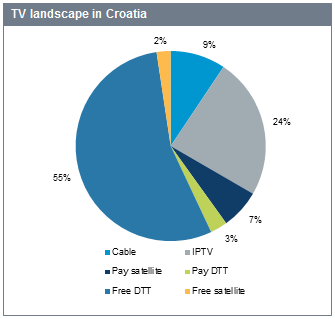

Historically IPTV has been the most popular form of pay TV in Croatia because of the developed telecom infrastructure, and successful pricing and marketing strategies by IPTV operators.. Over half of Croatian pay TV subscribers use IPTV. At the end of 2014 the largest pay TV operators were IPTV operator T-Com Hrvatska and multi-platform operator Vipnet.

Cable TV is popular in urban areas whereas satellite TV is most common in rural areas. There are three DTH operators and all of them belong to foreign parent companies: Vipnet (owned by Telekom Austria), Total TV (owned by Kohlberg Kravis Roberts & Co. LP (KKR)) and Hrvatski Telekom (Deutsche Telekom).

The analogue terrestrial signal switch-off took place in early 2011. DTT multiplex MUX-A reaches over 98.5% of the population and MUX-B is available to more than 95 % of the population. MUX-D reaches around 90% of the population of Croatia, and at least 70% of the population in each of the allotment regions. Close to 0.9 million households have free DTT as the primary source of TV and 39,300 have free digital DTH; no households receive analogue DTH signal.

There are 11 national and 21 regional TV channels available for free on the three DTT multiplexes including SPTV, a sports channel which shows a large variety of sports events including domestic league football and ATP/WTA tennis tournaments. The most popular channels in 2014 were publicly-owned channel, HRT1, and two commercial ones, Nova TV and RTL. This suggests that the wide availability of channels has driven the growth of the free DTT platform, which in 2014 was the largest TV platform in Croatia.