Market overviews 2015 — Western Europe

There are 179 million TV households in Western Europe. Digitization of TV distribution platforms in Western Europe is almost complete in the region with the exception of cable. 9 out of 10 TV homes in Western Europe watch digital TV. In 2006 Western Europe started to plan and implement the analogue to digital transition of terrestrial TV broadcasting, setting benchmarks for other regions. The satellite TV platform Western Europe is digital. Cable is the only platform which is not digital yet, with 42% of cable homes in the region receiving analogue signals at end-2014.

Pay TV has a high penetration rate in Western Europe with 58% of households subscribing to a paid service.

Public Service Broadcasters like the BBC (UK), RAI (Italy), ARD (Germany) and France Television (France) took a leading role in launching new DTT channels in their respective countries and closing their analogue channels, encouraged by their governments. Governments in Western Europe were the drivers of the digitisation of the terrestrial platform, primarily because they wanted to auction the terrestrial frequencies in the UHF band. Greece was the last country to switch off its analogue terrestrial TV network in February 2015, following the rest of the region which had switched by end-2012.

Kingston Communications launched the first IPTV services in 1999 in the UK. IPTV is primarily offered as a bundled service by telecom operators. In 2014, IPTV services are offered in all Western European countries.

Netherlands Key facts – 2014

- Population: 16.8 million

- Households: 7.5 million

- TV Households: 7.4 million

- Pay TV Penetration: 98.6%

- Broadband Penetration: 93%

- Mobile Penetration: 111%

TV Ad Revenue: €966 million

| Netherlands — platform overview 2014 | |||

| Pay subs (‘000) | Free subs (‘000) | Platform digitization (%) | |

| Terrestrial | 441 | 54 | 100 |

| Satellite | 673 | 53 | 100 |

| Cable | 4,448 | 0 | 81 |

| IPTV | 1,755 | 0 | 100 |

| Total | 7,317 | 107 | 89 |

The public service broadcaster in the Netherlands, NPO, operates three national general entertainment FTA channels, eight thematic channels and one international channel, BVN, created in collaboration with the Belgian public service broadcaster VRT. Two companies dominate the commercial FTA TV market in the Netherlands: RTL Group, which operates five FTA channels and SBS Broadcasting Group which operates four FTA channels.

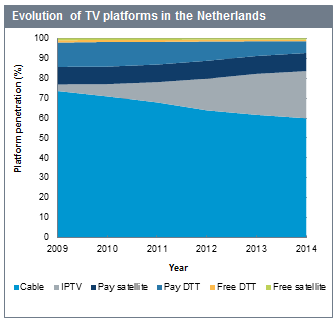

The Netherlands is the most heavily pay TV penetrated market in Western Europe, with 98.6% of TV households taking a pay TV service. The market has historically been pay TV heavy — penetration has remained above 90% since 1999 as a result of a mature cable platform. Furthermore, the Dutch free-to-air sector is small in the Netherlands as a result of the absence of an extensive free DTT offering. Whilst a public service DTT multiplex exists, the large bulk of terrestrial in the Netherlands is provided commercially by the incumbent Dutch telco KPN through its Digitenne service, which launched in 2003. This resulted in a further boost in pay TV penetration in the run-up to digital switchover in 2006, due to former analogue terrestrial households mostly switching to low-end pay services. Luxembourg-based operator M7 Group’s Canal Digitaal satellite operation also benefited from the switchover, resulting in a decline in cable’s market share.

Post-switchover, cable’s biggest challenger to its dominance has been KPN, which in addition to DTT operates an IPTV service that has emerged as a formidable competitor in the last five years, becoming the second largest platform in 2012. This has partly resulted from KPN upselling DTT services to IPTV.

Most recently further competition has arrived from over-the-top platforms, including Netflix, which launched in September 2013. This increasingly competitive situation has resulted in further consolidation in the cable sector from the combination of operators UPC and Ziggo in 2014 – the latter of which was the result of the merger of three cable operators back in 2006. Thus far, there has been no decision to require Ziggo to open up its networks for competition. However, KPN is required to grant third-party providers access to its networks for the next two years. Vodafone is one example of an operator that plans to make use of these networks to compete with KPN and Ziggo.

Despite its decline in market share, cable remains the dominant platform in the Netherlands. As with most cable-heavy markets, the conversion of analogue cable to digital cable is an ongoing process in the Netherlands. At the end of 2014, around 81% of cable users were using digital services.

Finland Key facts – 2014

- Population: 5.4 million

- Households: 2.6 million

- TV Households: 2.4 million

- Pay TV Penetration: 83.1%

- Broadband Penetration: 74%

- Mobile Penetration: 182%

TV Ad Revenue: €267 million

| Finland — platform overview 2014 | |||

| Pay subs (‘000) | Free subs (‘000) | Platform digitization (%) | |

| Terrestrial | 225 | 347 | 100 |

| Satellite | 63 | 48 | 100 |

| Cable | 1,481 | 0 | 100 |

| IPTV | 270 | 0 | 100 |

| Total | 2,039 | 395 | 100 |

The public service broadcaster in Finland, YLE, operates four national channels, including the most popular FTA TV channel in the country, YLE TV1. The second largest FTA broadcaster and the most popular commercial broadcaster is MTV3, owned by Swedish Media conglomerate the Bonnier Group. The second largest commercial TV station is Nelonen (owned by Sanoma Media) followed by Bonnier-owned station Sub.

In contrast to other Nordic countries which are beginning to see signs of decline in pay TV saturated markets, Finland is a market in which pay TV has been slower to grow. Pay TV is particularly seasonal in Finland which has impacted its growth. This is especially true for the pay DTT sector, which is often affected by short-term subscriptions taken out for sporting events or holiday homes. This said however, the last few years have seen pay TV increase in growth, led by fixed-network multichannel services.

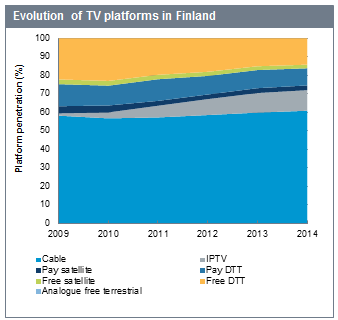

Where Finland is set apart in the Nordics is its full market digitization, following the switch-off of analogue terrestrial signals in 2007 and a move over to digital cable in 2008. The ambitious digital switchover process resulted in rapid growth in pay DTT as a platform, however did not have the same impact for cable. Whilst cable as a platform is by no means in decline in Finland, its growth has been steady at best. IPTV has been the fastest growing pay TV platform in Finland over the last few years, but we also do not expect this to accelerate to a great degree in the forecast period. That said, the size of the FTA sector and the relatively slow pace of pay TV growth suggest there is still some room for expansion in Finland in the short term. In the longer term, the increasing prevalence of online services, which are already showing signs of influence on other Nordic markets, could dampen pay TV growth.

Structurally, both cable and DTT platforms Finland have moved towards a trend of consolidation in recent years, with the most recent example being cable operator DNA’s purchase of pay-DTT service Plus TV in 2013. Together with its acquisition of cable operator Welho in 2010, this has made DNA the largest pay TV operator in Finland, with around 40% of the pay TV market in 2014.

Pan-Nordic DTH satellite operators Viasat and Canal Digital are present in Finland, however the market has always been the least significant for these operators. Satellite in Nordic markets has been in decline for some time, with Finland being no exception to this rule. This has resulted in Viasat and Canal Digital launching OTT TV services Viaplay and Canal Digital GO respectively, with Viasat particularly shifting its strategy to online offerings.

Austria Key facts – 2014

- Population: 8.6 million

- Households: 3.7 million

- TV Households: 3.6 million

- Pay TV Penetration: 47.2%

- Broadband Penetration: 67%

- Mobile Penetration: 145%

TV Ad Revenue: €488 million

| Austria — platform overview 2014 | |||

| Pay subs (‘000) | Free subs (‘000) | Platform digitization (%) | |

| Terrestrial | 12 | 164 | 100 |

| Satellite | 101 | 1,805 | 100 |

| Cable | 1,270 | 0 | 56 |

| IPTV | 278 | 0 | 100 |

| Total | 1,661 | 1,968 | 85 |

The public service broadcaster in Austria, ORF, is the dominant FTA TV operator in the country. ORF offers one general entertainment channel and three thematic channels. It also operates an international channel in the German language, 3sat, which was created in collaboration with the German public service broadcasters ZDF and ARD and the Swiss public service broadcaster SF DRS. The first commercial TV station in Austria was ATV, owned by the German-based company Tele Munchen Gruppe, which was followed by a second commercial channel, ATV II. Puls 4, owned by the German Media conglomerate ProSiebenSat.1 Media AG, is another popular commercial channel in Austria.

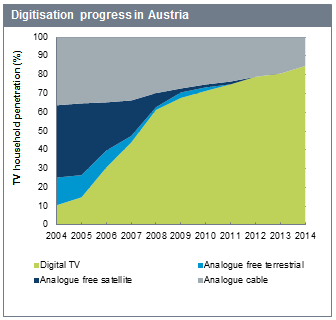

The Austrian market has parallels with the German market in that lower-end pay and free-to-air sectors still have a fair chunk of market share. Free satellite holds a good proportion due to the large amount of FTA channels available in Austria through Astra orbital slots coupled with the superior coverage satellite offers over fixed-network. Whilst the majority of the satellite channels are encrypted and require the purchase of a smartcard, we still define this as a free platform due to the absence of monthly payments. In 2014 digital free satellite increased further in Austria due to the movement of analogue cable subscribers to digital satellite. This is a rare case in Western Europe and suggests Austrian consumers have a preference towards long term investments in equipment over monthly pay TV subscription fees.

Whilst Sky is present in Austria, IHS accounts for this arm of its business in Germany. We currently estimate its subscriber base exceeds 300,000 subscribers. Luxembourg-based M7 also operate a pay DTH service, however a large amount of this is German FTA channels repackaged in HD format.

Austria switched off analogue terrestrial signals in mid-2011 following a steady switchover process, whilst analogue satellite ceased in 2012. However, in another parallel with Germany the conversion from analogue cable to digital cable has been a slow process. At the end of 2014, 58% of total cable subscribers had switched to digital. In some cases analogue cable is perceived as free in Austria, particularly if it is bundled with household utilities. Austria’s regulator RTR is currently working to promote awareness of digital cable, whilst the largest cable operator UPC offers unencrypted digital. Further digital advances are to take place in future with the full conversion of DVB-T terrestrial transmission to DVB-T2 set to commence in 2016, with an expected completion date of 2019. From 2013 DTT service SimpliTV has offered DVB-T2 on a pay basis, however this has shown no signs of growth so far.

IPTV is offered by incumbent telco Telekom’s Austria A1 service, which has grown at a steady rate over the last few years. However, IHS does not expect this service to exceed 10% total market share.

Italy Key facts – 2014

- Population: 61.2 million

- Households: 25.5 million

- TV Households: 25.3 million

- Pay TV Penetration: 30.2%

- Broadband Penetration: 55%

- Mobile Penetration: 141%

TV Ad Revenue: €3.2 billion

| Italy — platform overview 2014 | |||

| Pay subs (‘000) | Free subs (‘000) | Platform digitization (%) | |

| Terrestrial | 2,805 | 15,639 | 100 |

| Satellite | 4,734 | 2,003 | 100 |

| Cable | 0 | 0 | 0 |

| IPTV | 81 | 0 | 100 |

| Total | 7,620 | 17,642 | 100 |

The Italian FTA TV market is dominated by public broadcaster RAI and commercial group Mediaset. RAI currently offers 13 channels (some of them thematic) while Mediaset provides 11 FTA channels, as well as a number of pay TV channels. Other major FTA commercial broadcasters in Italy are Discovery Italia (a branch of Discovery Networks Southern Europe) and Cairo Communications (which also owns the TV business of Telecom Italia).

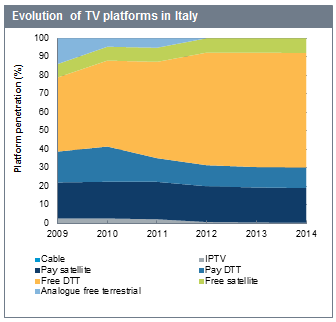

The Italian market is a challenging one for pay TV, owing largely to economic conditions which have stunted pay TV growth. To an extent pay TV is also affected by short-term subscriptions driven by football seasons. As a result, currently free TV outweighs pay TV in Italy. IHS does not expect this situation to change in the forecast period given the challenges pay TV continues to face.

In contrast to the similarly FTA driven markets in Germany and Austria, DTT is the main driver in Italy rather than satellite. Public service broadcaster RAI and Mediaset co-operate on the provision of FTA content, which offers an extensive portfolio of thematic channels, the range of which ensures its strong market situation. Italy completed its analogue switch-off in July 2012. Licences for three additional DTT multiplexes were put up for auction in February 2014, however interest for this was limited, with only one multiplex taken by Italian media group Cairo Communications.

At present the Italian pay TV sector is an intensely competitive two horse race between satellite player Sky and pay DTT operator Mediaset Premium. There is no cable platform in Italy and IPTV’s market share is negligible. This said, Telecom Italia announced a renewed interest in the IPTV sector in April 2015 via the launch of an IPTV service in partnership with Sky.

Of the two key players currently active, Sky has the greater scale and the biggest market share. However, Mediaset has continued to challenge its rival on content, particularly in relation to movies and sports rights, such as the Serie A football championship. With the current size of the FTA market in Italy at around 70%, both operators currently have a sizeable share of the market to target.

UK Key facts – 2014

- Population: 63.9 million

- Households: 28.7 million

- TV Households: 28.4 million

- Pay TV Penetration: 56.5%

- Broadband Penetration: 84%

- Mobile Penetration: 131%

TV Ad Revenue: €4.9 billion

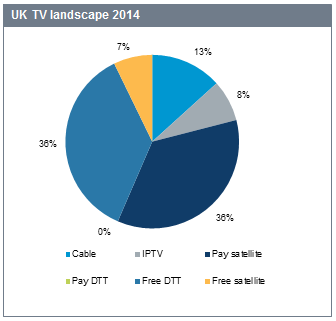

| UK — platform overview 2014 | |||

| Pay subs (‘000) | Free subs (‘000) | Platform digitization (%) | |

| Terrestrial | 0 | 10,303 | 100 |

| Satellite | 10,079 | 2,051 | 100 |

| Cable | 3,770 | 0 | 100 |

| IPTV | 2,190 | 0 | 100 |

| Total | 16,039 | 12,354 | 100 |

The UK has one of the richest and most diverse FTA TV markets in Europe. More than 55 channels (11 of them in HD) are offered for free via the digital terrestrial platform, Freeview. In addition, free satellite platform Freesat offers more than 200 channels. The public service broadcaster of the UK, the BBC, currently operates ten domestic channels plus a number of international TV channels, operated by BBC’s wholly owned commercial subsidiary BBC Worldwide. ITV is the second largest FTA broadcaster of the country, operating five domestic FTA TV channels plus several channels available exclusively to pay TV platforms. The third largest FTA broadcaster in the UK is Channel 4, which offers six domestic channels (excluding time-shifted versions of its most popular channels). Channel 5 is the fourth largest FTA broadcaster in the UK offering one channel plus two time-shifted variations.

The pay TV market in the UK has historically been dominated by satellite operator Sky, owing largely to its exploitation of exclusive sports and movie rights. This is still the case – the operator held 62% of the pay TV sector in 2014. However, its dominance has not been without challengers.

IPTV has proved itself an aggressive competitor, with both BT and Talk Talk growing their subscriber bases via bundling predominantly FTA packages with multiplay offerings. BT has been particularly forthright in its challenge via heavy investment in sport, however Sky has retained key rights for Premier League football following a bidding war in February 2015 with BT and the BBC which exceeded £5bn in value. This indicates sport is a key driver of pay TV in the UK, and as a result we are not expecting significant movements within the sector.

Cable is the second largest pay TV platform in the UK, with customers currently served by Virgin Media, which was acquired by pan-regional US operator Liberty Global in 2013. The operator fully converted its analogue cable subscriber base to digital in November 2013. Whilst the platform has not experienced rapid growth of late, its customer base has been largely stable owing to its competitive internet and multiplay offerings.

The competitive landscape in the UK has been further shaken up by the increased popularity of online TV services such as Netflix and Amazon Prime. This has resulted in both Sky and Virgin launching services to compete effectively. Sky’s approach has been to launch a standalone service NOW TV and a multiscreen service Sky Go for subscribers, which have so far shown signs of success for the operator. Virgin’s strategy has been geared towards customer retention, with both the launch of the connected TiVo set-top box and a distribution deal with Netflix.

Analogue switch-off occurred in the UK in October 2012. The FTA television segment in the UK continues to be strong, largely owing to the high number of channels offered by Freeview on free DTT and Freesat on DTH. Pay DTT however was a failure in the UK, with the services Top Up TV and OnDigital both closing having failed to amass significant customer bases.